As small and medium-sized businesses (SMBs) navigate an increasingly complex landscape, integrating Artificial Intelligence (AI) into their daily operations is becoming more essential. The recent announcement from Finally, a Miami-based fintech startup, highlights the significant role AI can play in enhancing efficiency, decision-making, and productivity. By gaining insight from their journey and investments in AI-driven workflows, other SMBs can harness similar technologies to optimize their processes.

Finally recently secured an additional $10 million in venture capital to further its mission of automating accounting and finance functions. This comes after a substantial $95 million round raised in 2022, aimed at launching small business lending and bookkeeping capabilities. Such investments signal confidence in the ability of AI to streamline essential business operations, an insight every SMB leader should heed.

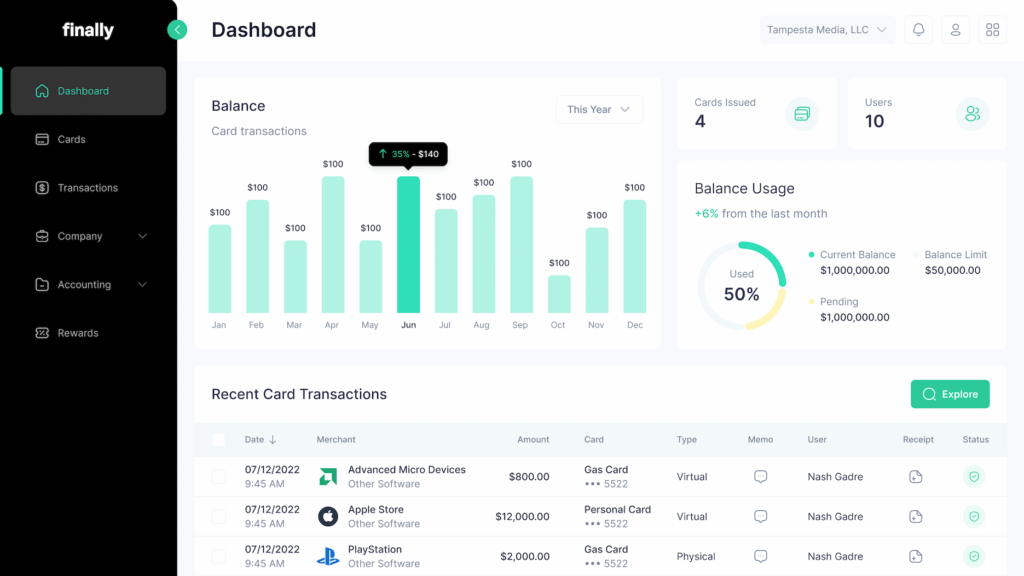

AI-driven workflows can drastically improve efficiency. For example, bookkeeping and expense management can consume enormous amounts of time for small businesses. By implementing an AI-powered ledger, companies can automate transaction recording, reconciling bank statements, and managing invoices, thereby reducing the human error often associated with manual entry. The implementation of a single, integrated application for various financial tasks allows businesses to free up valuable time for their teams, enabling them to focus on strategic initiatives rather than administrative burdens.

Conversely, business owners often struggle with making data-driven decisions due to the lack of real-time insights. AI can help mitigate this challenge by offering advanced analytics capabilities that transform raw data into actionable insights. By leveraging AI, SMBs can analyze trends in expense management, customer behavior, and revenue streams to inform decision-making processes. For instance, AI tools can flag unusual spending patterns or suggest budget adjustments based on historical data, thus empowering leaders to make informed choices that directly impact their bottom line.

Beyond bookkeeping, AI can enhance productivity by automating repetitive tasks across various functions. Bill payments, payroll processing, and customer service inquiries are prime candidates for automation. AI-driven chatbots can handle customer queries efficiently, reducing wait times and improving customer satisfaction. Likewise, automating payroll via AI can minimize errors while ensuring timely payments, thus maintaining employee morale and trust. The time saved from these automated tasks can then be reallocated towards activities that drive growth, such as market research or relationship-building with clients.

Practical advice for SMB leaders includes starting small with AI implementations. Identifying high-frequency, low-value tasks within the organization can present opportunities for initial AI integration. For instance, if an SMB spends significant time chasing billing inquiries, introducing an AI-powered inquiry system can drastically reduce the workload of administrative staff. Over time, as businesses witness the improvements in efficiency and reductions in operational costs, they can expand their use of automation to other areas, scaling up their AI capabilities.

From a financial perspective, the ROI of integrating AI is compelling. A study indicated that automating finance-related tasks could save businesses up to 20% in operational costs while improving accuracy and speeding up processing times. Additionally, by cutting down on time spent in routine functions, businesses can allocate resources more strategically, driving better results across marketing, sales, and product development—areas central to growth.

Finally’s recent developments also point to the importance of AI in creating a business ecosystem that supports various functions. With their focus on bringing together bookkeeping, expense management, bill payment, and payroll under one automated roof, Finally illustrates how comprehensive AI integration can establish a seamless flow—a flow that diminishes redundancies and enhances overall organization performance. Such integration not only promotes efficiency but can also improve cash flow management, offering businesses clearer visibility into their financial health.

As SMBs consider these advancements, it is critical to remain adaptable in adopting and exiting certain technologies. Finding the right AI solutions requires an understanding of company needs, as well as a willingness to engage in trial and error. Early adopters in the SMB space often face unique challenges, such as identifying suitable vendors and training staff, but these initial hurdles can yield substantial long-term benefits.

The experience of companies like Finally demonstrates that leveraging automation and AI can support SMBs in entering a new era of financial management. The investment in technology must be paralleled by a cultural shift within organizations, encouraging teams to embrace change and innovation. Only by fostering such an environment can SMBs fully realize the potential of these technologies.

As we move forward, the landscape for small and mid-sized businesses is changing rapidly. Those that take proactive steps to integrate AI into their workflows will not only streamline their operations but will position themselves as competitive leaders in their sectors. By recognizing the transformative power of AI, SMBs can create a foundation for sustainable growth and navigate the future with confidence.

FlowMind AI Insight: For SMB leaders, the pathway to harnessing AI-driven workflows lies in strategic implementation and a commitment to continuous learning. By embracing AI, businesses can unlock new efficiencies and make informed decisions that propel them toward long-term success.

Original article: Read here

2024-02-06 08:00:00